Before we get started, let me briefly explain that competitive analyses differ in two ways, depending on the goal and the occasion, and very importantly, why competitive analyses are not competitor analyses.

Because the terms are often used synonymously.

The two types of competitive analysis

As mentioned before, the competitive analysis is divided into two different variants depending on the goal and the occasion.

The first is the strategic analysis, in which the industry and its market leaders are examined. Here, factors such as the market constellation, the market position or the strengths and weaknesses of individual competitors are analyzed.

Through industry analyses, competitive comparisons and the creation of company profiles, the strategic competitive analysis provides you with a holistic view and gathers the necessary information for making strategic decisions.

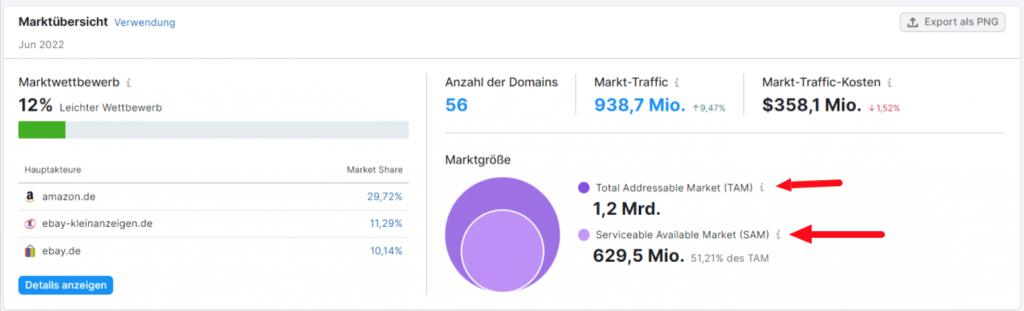

For example, if you want to gather strategic information for your online marketing, you can use tools like Semrush Market Explorer to get an overview of your competitors’ marketing activities.

The result tells you how big the market competition is, who is the biggest organic competitor within your industry, how high the total addressable market (TAM) is and how high the total serviceable available market (SAM) is.

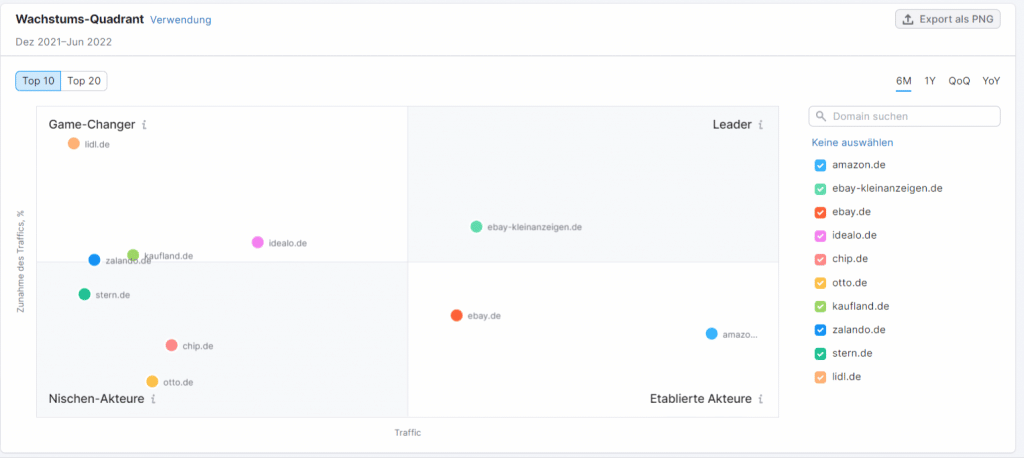

You can also determine your market position in a growth quadrant in these tools.

The second type of competitive analysis is the operational analysis. This type of competitive analysis is about identifying advantages and unique selling points by comparing competitors, products and services. This helps companies to better highlight and market themselves and the products and services they offer.

Why competitor analysis is not the same as competitive analysis?

Many people use the words competitor analysis and competitive analysis synonymously. But on closer inspection, this is not quite correct. Competitor analysis is a part of competitive analysis.

In competitive analysis, you look specifically at the products and services of direct and indirect competitors and examine them for strengths and weaknesses in order to determine competitive advantages and thus position yourself better in the market.

Competitor analysis, on the other hand, also examines competitors with the help of competitor analysis, but also looks at the market environment and the behavior of competitors.

The 6 steps to creating a competitive analysis

Now that you know what a competitive analysis is and what types there are, below I’ll explain the six steps you need to take to best conduct a competitive analysis.

Step 1: Determine the goals of your competitive analysis

Before you start your competitive analysis, the first step you should take is to clarify what goal you are pursuing with the analysis. In other words, what is the purpose of the competitive analysis? What do you want it to help you with?

For example, is it to introduce a new product? Do you want to identify performance gaps with your competitors? Do you want to strategically realign the company?

Whatever goal you are pursuing with the competitive analysis, it is important to clarify the objective at the beginning. Not only does it determine the nature of your investigation (strategic or operational), but it also determines what information you want to collect for your objective.

Let’s take an example:

You want to make an existing product more present in your market. The goal of the competitive analysis is to find out, for example, how your competitors manage to present their product better or more visibly to the target group.

To do this, we can look at where and, above all, how your competitors advertise their product and which stories and communication strategies they use to address their target group.

Let’s take another example:

As an employer, you want to improve your employer brand over your competitors in terms of recruiting new talent.

The goal in this case is to find out how well known your brand is as an employer compared to your competitors and what branding strategies they use to attract new talent and position themselves as an attractive employer brand.

Step 2: Determine comparison criteria for the competitive analysis

After you have clarified the goal of your competitive analysis and determined the information you need to collect for your objective, the next step is to select relevant comparison criteria.

Notice: If you've read other articles on conducting a competitive analysis from around the web, you'll notice that Step 2 is different for many. Some define step 2 as the step where you are supposed to identify your competitors first and then determine the comparison criteria as the third step.

You can do it that way, but I personally think it’s better the other way around. “Why?” you ask yourself now? I’ll try to explain why I set the comparison criteria first, before I identify the competitors.

The comparison criteria help you to find suitable competitors in relation to your criteria and to group them in different ways, for example into foreign, national, small, medium companies.

This grouping allows you in the end to improve the quality of your investigation and also to put more focus on the objective of your competitive analysis.

On the other hand, if you first search for your competitors and then define the comparison criteria, it can happen that you have found a large number of competitors, but they do not match some points of your comparison criteria and thus the quality of your research suffers.

Well, I hope this was understandable, why I suggest you in my article to define the comparison criteria first, before identifying the competitors.

Now let’s look at what are the possible criteria for the investigation. In the following, I have divided the possible comparison criteria into different categories. These should give you an idea of what categories there are and which ones you can use for your competitive analysis.

1. Company data

- Company size

- Turnover figures

- Number of employees

- Number of locations

- Legal form

- Company history

- …

2. Corporate Strategy

- Investments

- Market shares

- Organizational Structure & Management

- Personnel development & recruitment

- Projects & company expansions

- …

3. Product strategy

- Depth & breadth of assortment

- Brand assortment

- Pricing Policy

- Suppliers

- Quality standards

- …

4. Marketing strategy

- Marketing measures

- Marketing channels

- Marketing budget

- Marketing partners & agencies

- Communication & Addressing

- Target group

- …

5. Sales Strategy

- Distribution channels

- Distribution methods

- Logistics

- Cooperation partners

- …

6. Service

- Service channels

- Accessibility

- Complaint behavior

- Customer satisfaction

- …

As you can see, there are a lot of comparison criteria which can help you with your competitive analysis. They are by far not all. You can also define your own criteria for the analysis.

However, it is important not to use comparison criteria indiscriminately at the end, but to take those that also fit your analysis and your objective.

Step 3: Identify your competitors

Once we have defined our comparison criteria, the next step is to identify the relevant competitors.

Five to ten of your direct and indirect competitors are sufficient for this. Don’t just focus on the competitors you already know, but try to find competitors you don’t know yet.

For this you can use sources such as search engines, business directories, industry reports, trade shows and others.

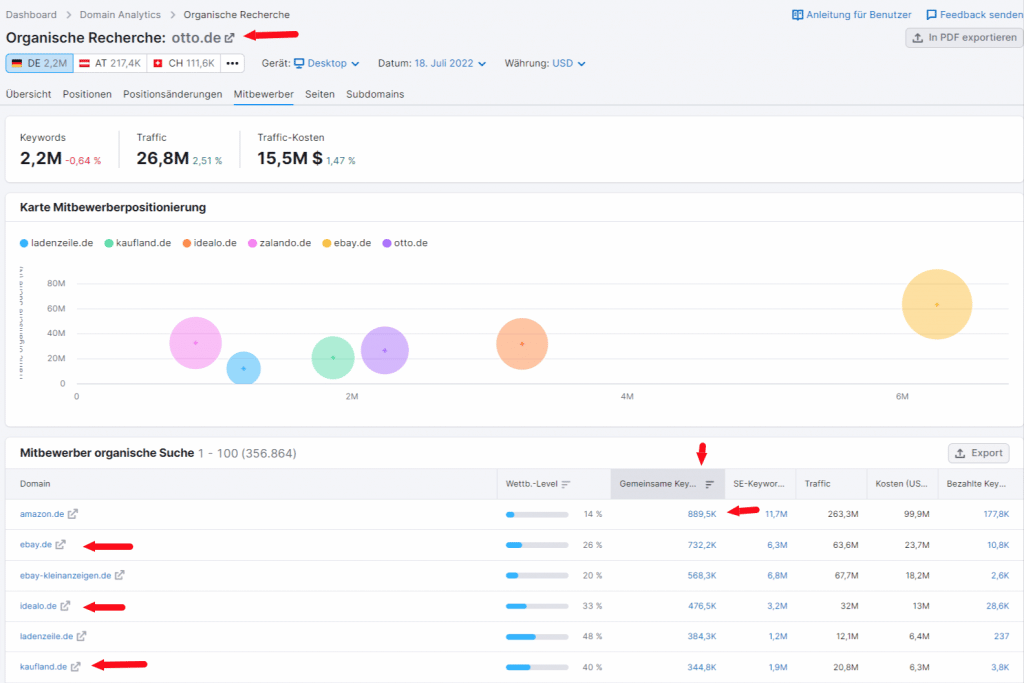

If you want to identify your competitors in online marketing, you can also do this here with the help of various tools. For example, you can identify your competitors in SEO by the number of common keywords for which your domain and those of your competitors rank at the same time. Here I have an example from Semrush’s organic research tool for you.

After you have made your list of direct and indirect competitors, define the most important ones for you and then start collecting the necessary data and information.

Step 4: Collect data about your competitors

You have defined your comparison criteria and now know your most important competitors. Then it’s a matter of researching the required information and data on your objective and, if necessary, collecting this, for example, with a survey.

Possible sources for the information research include annual reports, company registers, trade journals, market research reports, search engines, customer reviews, social media and more.

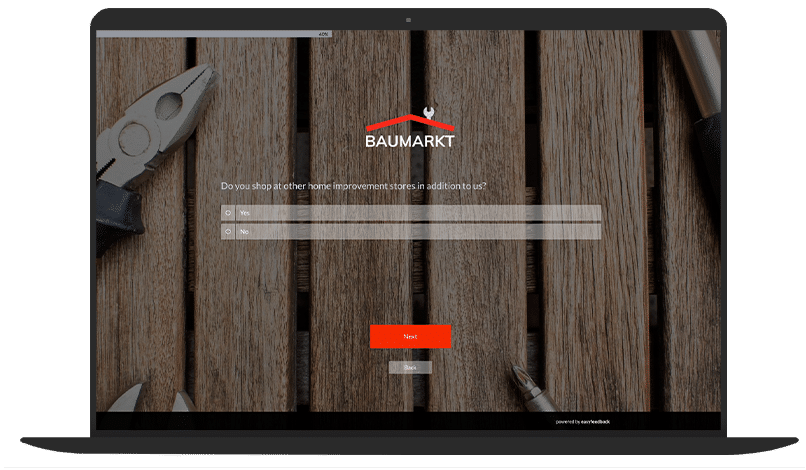

If you want to collect data for competitive analysis, it is recommended to use the potential of customer surveys. Because of their ease of design and enormous reach, you can ask detailed, targeted questions about the information you need for your research, from the perspective of your target audience.

In this case, we have developed a survey template that you can use directly, adapt or use as inspiration for your own competitive analysis survey.

Step 5: Analyze data and draw conclusions

“Analyze your opponent to learn his plans, his successful ones as well as his failed ones.” (Sun Tzu)

After you have collected and compiled all the information you need for your defined goal of the competitive analysis, the next step is the evaluation.

For this purpose, for example, the SWOT analysis can serve you as a clear table that shows you which strengths and weaknesses you have compared to your competitors and which opportunities and risks can develop in your environment or market.

From the conclusions you can derive targeted measures and thus strengthen your market position.

A tip from me:

For the evaluation itself, you should not only use current data and information, but also past ones.

These usually provide you with clues as to which plans and strategies your competitors have already pursued in the past, and which have worked or failed. The failed ones are interesting, as lessons can usually be learned and applied to new plans and strategies.

Let’s take an example of this:

You want to set up a new social media campaign for your product. So first research what your competitors are currently doing on social media, where they are placing the product, how they are communicating the product to the target audience, what imagery you are using, and what the thematic focus/storyline is in the campaign.

Then you look at past social media campaigns. This can be done well for example with the tool AdSpy, Bigspy or with social media’s own advertising libraries like facebook, LinkedIn, TikTok etc.

Now you can gather the information and make a comparison between the current and past campaigns. From this you can draw conclusions on what has changed between the campaigns.

Another tip:

Since not every marketing campaign always achieves the desired effect, it is especially true in marketing that you try out many things and learn from your mistakes.

Moreover, the comparison also helps you to learn from the past mistakes of your competitors, to use working measures for yourself or to create something completely new and extraordinary from the already posted material.

Step 6: Derive and implement measures

Now that you have conducted your competitive analysis and drawn the right conclusions for you, you should of course follow up with action. Otherwise, all your efforts and research will have been in vain.

Therefore, think specifically about which measures you can take from the conclusions, prepare them well and implement them.

>> Video: Derive measures from the results of a survey <<

Conclusion: Competitive analyses – the basis of every strategy

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.” (Sun Tsu)

Hey, glad you made it to the end of my post. Don’t worry, I’ll try to be brief here and just give you some more important information.

As explained earlier in this post, competitive analysis helps to strategically examine your target market, your current as well as potential competitors, their behaviors as well as the target audience and the products and services offered.

The result is an insight into how competitive the target market is, what the chances of success are for entering a new market or launching a new product, and what the competitors’ marketing and sales strategies look like.

Thus, it forms the basis of any entrepreneurial strategy and the foundation for making decisions based on the information.

Competitive analyses are also not as complex to conduct as it is assumed, but they do take time and intensive research work. You have to be prepared for that. But the time and work are worth it.

Because you not only create a strategic overview for yourself, but also reduce your ignorance.

“The greatest vulnerability is ignorance.” (Sun Tsu)

Because ignorance leads us to grope in the dark, not seeing what may come our way or making decision often wrong or not right. And this is not only the case in private life. Ignorance can also be a problem in the corporate context.

Especially when companies want to compete strategically, they cannot do so without first knowing where their own strengths and weaknesses lie, who their competitors are in the market, and what their strengths and weaknesses are.

So my final tip:

Keep your eye on the ball and make it a point to do a competitive analysis at least once a year. If you don't keep an eye on your competitors from time to time, sooner or later you will have to watch them pass you by.

More about competitor analysis

- Competitive analysis explained simply

- 7 Methods of competitive analysis

- 8 Key metrics for a competitive analysis

- Competitor Analysis: 7 important criteria for evaluating the competition

- Competitive analysis in the context of marketing: Strategically understanding and utilizing the market

- Competitive analysis in HR marketing: Strategies for the best talent