What is Customer Lifetime Value?

The CLV indicates the total revenue that a company can expect from a customer throughout the entire business relationship.

It takes into account not only current sales, but also future earnings.

This makes the CLV an important parameter for assessing the long-term value of a customer.

Why is the CLV important?

- Reason: Cost optimization

The CLV helps to justify the expenses for customer acquisition as it shows the long-term value of a customer. - Reason: Resource allocation

Companies can identify profitable customers and deploy their resources in a targeted manner. - Reason: Customer loyalty

A high CLV is often a sign of strong customer relationships and loyalty. - Reason: Long-term planning

The CLV provides valuable insights for making strategic decisions, e.g. for product development or pricing.

How is the CLV calculated?

There are various approaches to calculating the CLV.

A simplified formula is as follows:

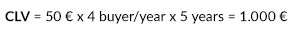

Example:

- Average revenue per purchase: €50

- Purchase frequency: 4 purchases/year

- Customer retention period: 5 years

In more complex models, costs, discounts and other factors can also be taken into account.

Measures to maximize CLV

1st Measure: Strengthen customer loyalty

- Develop customer loyalty programs, e.g. loyalty programs or personalized offers.

- Example: Discounts for regular customers increase purchase frequency.

2nd measure: Upselling and cross-selling

- Offer additional products or upgrades to increase sales per customer.

- Example: A streaming service offers a premium subscription.

Measure 3: Improve customer satisfaction

- A positive customer experience leads to longer business relationships.

- Measures: Fast customer service, user-friendly processes.

Measure 4: Targeted customer acquisition

- Focus on target groups with high potential for a high CLV.

- Use data analyses to identify such customers.

Challenges with CLV

- Data quality:

Inaccurate or incomplete data can make the calculation more difficult. - Complexity:

Integrated models are more demanding as they have to take many variables into account. - Short-term decisions:

A strong focus on short-term gains can work against long-term CLV goals.

Conclusion

Customer lifetime value is an indispensable key figure for companies that want to grow sustainably.

It makes it possible to recognize the long-term value of a customer and take targeted measures to increase profitability.

Although calculating and optimizing CLV can be challenging, the benefits are enormous: stronger customer loyalty, higher sales and a clearer focus on long-term success.

By integrating CLV into your business strategy, you are not only investing in your customers, but also in the future of your business.