Preliminary considerations for creating a customer survey

A methodical approach to a customer survey is characterized not only by the correct structure of the questionnaire, but also by structured advance planning.

So before you start actually creating your questionnaire, think carefully about the following topics to determine important key points of your survey:

- What stage of the customer lifecycle are your survey respondents in? You will deal differently with customers who are in the initiation phase than with customers who are in the active product use phase, for example.

Think about what you want to find out and which customer group you want to survey. - Consider what sample size makes sense, because you will rarely conduct a full survey.

- What is the subject area of your survey? Will you conduct a multidimensional customer survey, i.e. deal with several topics or only with one survey topic?

- What is the goal of your survey? What do you want to investigate, why do you want to investigate it?

- What is the planned frequency? How often will you conduct your survey? Once? At regular intervals? After improvements have been made?

If you’re unsure about any of these points and need tips and methods to go along with them, download our customer survey design manual.

This blog post is an excerpt from the manual, which mainly explains how to create the survey. However, in the manual I also explain these preparatory steps in detail.

But if you are already clear about all these topics, then we can dive straight into the method for creating the questionnaire for your customer survey.

Method for structuring the questionnaire

The best method for creating a good questionnaire is: keep it short.

The shorter the survey, the more participants will finish filling it out.

More important than the number of questions here is how long it actually takes to complete and how tedious it is. This is another reason why there is no golden rule for how many questions is the right amount.

Questions about demographic data

Almost all surveys start with the so-called demographic data. For example, age, gender, place of residence and the like.

Think very carefully about what you need to ask here. Many people like to express their opinions, but don’t want to reveal personal data about themselves.

First and last names can be difficult for some people. The exact age, on the other hand, for others. And when it comes to income, most people’s willingness to provide information reaches its limit.

Therefore, it has proven useful to ask only for the following data:

- Age group (e.g., in four to five groups such as 18-29, 30-49, 50-65, >65)

- Gender (female, male, divers/no specification)

- Country where you spend most of your time

Keep the following in mind when creating the demographic questions:

- Less is more

Besides these three questions, you should only ask everything else if you really have a reason to do so. Therefore, ask yourself if the answer to a question will change the results of the survey and if it will have an impact on your analysis.

If you can’t answer that with certainty, it’s better to leave the question out in case of doubt.

- Icebreaker

From a methodological perspective, demographic data at the beginning of a survey has an added benefit: Respondents are used to answering these questions and find it easy to give the answers. It’s an easy way to get your customers off to a good start with your customer survey.

- The beginning or the end?

In rare cases, it may make sense to ask for the demographic data at the end. You do this if the things you asked before are valuable even without that info. Because users may not want to answer the demographic questions.

Open and closed questions

Generally, questions are divided into two types:

- Open questions:

These are those in which users freely report – so they usually see a text box in which they type their answer. - Closed questions:

This is where you provide the answer choices. The simplest case:

“Do you know our product?”

• Yes

• No

Deciding for open or closed questions

Think through the following points to help you distinguish between open and closed questions, not just from your gut, but with method:

- Your goal: speed and convenience

In general, it is important to know that closed questions are much faster to answer. Closed questions are therefore more convenient for customers. And closed questions are also more convenient for you.

Because reading, understanding and structuring the customer’s texts takes a lot of time and effort. Especially with larger samples. With closed questions, on the other hand, you can see the results at a glance.

- Your goal: Collect new ideas, develop in-depth understanding

However, if you want qualitative data and are interested in a topic that you don’t yet know much about from the customer, open-ended questions are the right method.

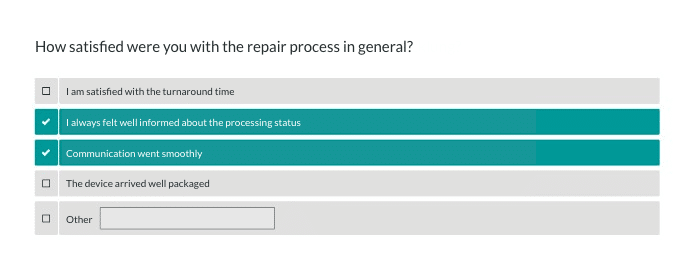

In an initial survey, for example, you can openly ask how satisfied customers were with the repair process in general. Then you’ll get lots of answers. In all likelihood, a handful of answers will emerge that will be given again and again. The next time you do a survey, you can ask a closed-ended question, and based on the answers that have been given over and over again, you can set the answer choices:

- I am satisfied with the turnaround time

- I always felt well informed about the processing status

- The communication worked smoothly

- The device arrived well packaged

Finally, you can use a combination of both question types and specify “Other:” as the last answer option, followed by a free text field.

In this way, you give those who did not find themselves in the given answers an opportunity to report their particular case.

Which answers should you make mandatory?

As a company, you naturally want all your questions to be answered. And yet, you should think carefully about which questions you make mandatory. Think about the following points when defining mandatory questions:

- Which questions are so important that the user cannot leave them unanswered?

- Caution: In general, every mandatory question carries the risk that customers will abandon at this point.

- The environment matters: If survey participants only have to answer five questions, your survey can handle more mandatory questions than a survey with 20 questions, for example.

- However, if customers skip a question, it can also mean that they can’t answer a question. Therefore, you should provide a “don’t know,” “unsure,” or “don’t specify” option for such mandatory questions.

Method for sorting and ordering the questions in your customer survey

The order of the questions plays a decisive role in the quality of your results. Most important principle: Your method of sorting the questions is based solely on the participants.

For example, if both the marketing and support departments have questions in your survey, you tend to sort the questions into two blocks. This may be a clear structure for you – but probably not for the customer.

Dramaturgy of the questionnaire

A good method is to have some dramaturgy in your survey.

- You start with a few easy questions to warm up. Demographic data, for example, is a good question to ask here. Ideally, these are all closed questions with few possible answers.

- Then you can go into more detail. One or two open questions would be conceivable now, if you have to collect qualitative data. But then there should always be a block of two or three closed questions. That way, the customer has the feeling that he or she is constantly moving forward and is not stuck in one area for too long.

- The most difficult questions are best asked shortly after the halfway point.

Dealing with difficult questions

Tasks can be difficult for two main reasons:

- The users feel that the question is too personal. These can be questions about financial circumstances, for example, but also those about politics, faith or lifestyle habits (diet, sport, drugs, sex).

- The answer is difficult for the customer. This means they have to think about it for a longer time.

It’s best to pose such tasks only after the user has already completed a good part of the survey. Then, for one thing, he is already in the flow. And on the other hand, they are less likely to abandon the survey because they fear that their previous input will have been in vain.

And finally, you’ve already gotten responses to the first half of the survey. Therefore, you should make sure that the absolutely essential questions are asked as early as possible. This way, you can at least partially use the answers of dropouts for evaluation.

Tips for formulating questions in your customer survey

First tip: Do not formulate the questions in the group. Ideally, you should define the goals, target group and procedure together as a team. How this information is then elicited through a survey should be in the hands of a single person.

Usually the others in the team want to see the finished questionnaire again. That’s fine, but it’s best to present the customer survey to everyone together. This gives you the opportunity to explain the method you used and how the structure came about.

Avoid leading questions, formulate clearly

If you are interested in honest answers, you should formulate your questions as neutrally as possible. We rarely do this in everyday life, and sometimes neutral questions sound a bit awkward or awkward. Nevertheless, this is always the best way to go.

Instead of:

"How well did you like the offer? "

You better ask:

"How well or poorly did you like the offer? "

And it is also good to be as specific as possible, so that all users understand the same thing and do not interpret the task differently.

Do you just ask:

"How well or badly do you like our offer? "

It may be that one customer thinks of everything he has ever seen on your site. But another one might only think of the (special) offer he just clicked on in the company newsletter and landed on the website through it.

Therefore, such a formulation would be better:

"How comprehensive or limited do you consider the product selection on our website? "

Avoid answering tendencies

The order in which you ask questions matters more than you might think. There are many exciting factors here, known from psychology. Some of them are particularly interesting for creating questionnaires.

Positive / negative influence

Let’s take an example: Your company is known for having an excellent selection, customers praise that over and over again. The service, on the other hand, has been lacking lately.

If you let customers rate the selection first and then the service, the service will perform slightly better than expected. If, instead, you first ask about the service and then about the offer, the offer will score worse.

No one is immune to this, even psychologists who are aware of such influencing factors succumb to it – it’s human.

Therefore, a simple trick is to display such questions in the customer survey in random order. This is called randomization. This way, the response tendencies balance out in total and you get solid results for your evaluation.

Anchoring

The so called anchoring is used more often by sales people: For example, they first name the price of a competitor’s luxury item and only then name the price of their own product – which thus appears more favorable to us humans than if the sellers had only named their price.

In the same way, people tend to make higher estimates when they have read large numbers beforehand. They don’t have to have had anything to do with each other either.

So if you first ask people how many inhabitants Berlin has, their estimates will be higher for the following question about how often Germans go on vacation each year.

So be careful if you ask several numerical questions in a row in your survey. A good method is to separate them by a few other questions without numbers. Or you can use the randomization method again.

Yes-say tendency

The yes-say tendency means that most people tend to answer questions in the affirmative. If you want to counteract this, formulate your questions in such a way that they are more likely to be answered in the negative.

So instead of:

"Are you satisfied with our service? "

write:

"Are you dissatisfied with our service? "

You do this, for example, when you ask for a brief explanation of the answer in the next question. This way you will get more people to provide valuable information here and you can learn more about their customer satisfaction.

Tendency towards the middle

Then there’s the tendency toward the middle. That is, if you give your customers a multi-level answer (such as “very good – good – neutral – bad – very bad”), then many respondents tend to take the middle value.

Tendency towards mildness/harshness

Finally, the tendency towards mildness/harshness: this means that the top and bottom ends of a scale are selected by customers in the survey with above-average frequency.

Depending on the task at hand and the character of the customer, the tendency toward the middle or the tendency toward mildness/harshness may be more pronounced.

There is not much you can do about these tendencies. Make sure that your questions are formulated in an understandable way. That they are neutral and not suggestive. And keep the possible tendencies in mind.

Selecting and presenting question types

When setting up the survey, many CX managers face the challenge of choosing an appropriate question type to best present a question. In the following sections, we’ll cover how best to go about this.

The three most commonly used forms of how you enable responses are:

- Radio buttons

- Checkboxes

- Text boxes

Additionally, there are:

- Popup & pulldown menus

- Scales

- Matrices & tables

- Sort lists or ranked lists

Radio buttons & checkboxes

Radio buttons have the property that only one option can be active at a time. For example, for a question to which the user can only answer yes or no – both are not possible.

In addition, a radio button cannot be reset to its default state – once the user has made his selection, he can only select another radio button in the same answer field, but not nothing.

If a question allows multiple answers to be selected (multiple choice), not just one, then use checkboxes.

Notice: Checkboxes allow multiple responses, while radio buttons allow only one.

Text fields

There’s not much to say about text boxes – just two things:

- The size of the text box implicitly conveys to respondents how much text you expect. If the text box only has room for ten characters, most will give one-syllable answers. And those who want to write more may get annoyed.

- Make sure the text is legible. Set the font size to about 16 point so that anyone on any device can easily see the content.

Too small of a text box or too small of a font in the text box will, sometimes unknowingly, cause stress – and thus worse responses.

Popup & pulldown menus

Menus are generally only second choice. With menus, respondents in your customer survey have to click more – they have to open the menu and then select content from it. Even more unfavorable: They do not immediately see which answer options are possible.

Rule of thumb:

- If you have fewer than seven answer choices, a column of radio buttons or checkboxes is fine.

- Up to 14 answer choices, two columns will do.

- If there are more choices, consider splitting the question. Or offer a free text field.

- If all this is not possible, then use a menu.

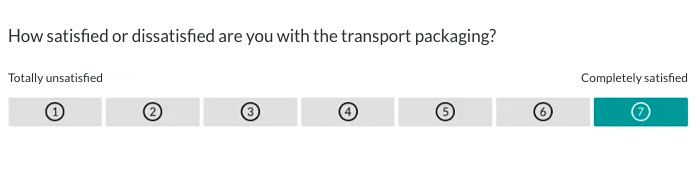

Scales

If you have a lot of answer options, it makes sense to opt for the scale method. This allows your customers to give differentiated answers. There are not only yes or no, but also options in between. For example, you specify

- good

- average

- bad

Then you have a three-level scale, which is rather unusual. Mostly you work with 5- or 7-level scales, like:

- very good

- good

- average

- bad

- very bad

In general, you need to make two main decisions for your customer survey when using scales:

- How many response options do you offer?

This is always a trade-off: the fewer, the easier it is to answer. But it may also be that some customers want more levels.

And the more levels, the more differentiated the picture you end up with. Therefore, less than five levels are not useful for ratings. Seven levels are also common. However, more than seven levels are rarely seen and won’t help you learn more.

- Should the scale be even or odd?

Experts have been arguing about this question for decades. From my point of view, the current state of research is to work with odd scales. This allows customers to give neutral answers. This seems better than forcing them to choose sides in the survey.

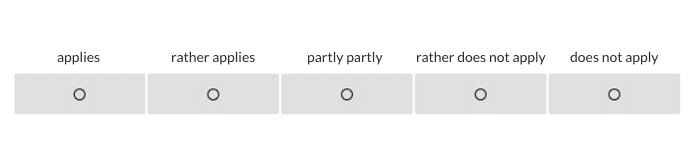

Scales that you use to measure agreement with a statement are called Likert scales. For instance:

- Agree

- rather agree

- partly-partly

- rather does not apply

- does not apply

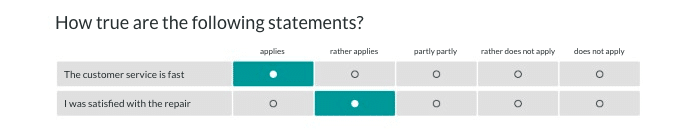

Matrices & tables

If you have several questions of the same type that belong together in terms of content, it is best to combine them in a table when creating your customer survey – this is also referred to as a matrix.

This is common, for example, with the Likert scales just mentioned. It could look like this in your survey:

However, if the questions do not belong together in terms of content, you should not present them together in your customer survey either. This is not only confusing for the user, but also for you during the evaluation.

Sorting lists or ranking lists

Finally, there is one last type of answer: the ranking or sorting list. Here you give several terms and ask the respondents to put them in a certain order.

You can use this, for example, to ask about the importance of different categories. This could look like this in your customer survey:

Survey fine-tuning and pre-testing

Time for the finishing touches. You’re pretty much done, but here are a few important tasks to take time to finish up:

- Give instructions and guidance to survey participants: Clear instructions are especially important for online surveys.

- Manage expectations and explain why you are asking the questions and what will happen to the answers. Mention approximately how long it will take participants to complete the customer survey.

- Include a progress indicator when implementing online surveys; this motivates participants.

- When error messages appear, make sure that they are worded in a friendly manner so that users remain motivated.

- Thank the user at the end of the customer survey. It’s also best to explain again what you will do with the results.

The customer survey test

Once the questionnaire for your customer survey has been drawn up, you should pause for a moment before letting the customers go at it.

With a pre-test, you have three to five users from the target group answer the questionnaire in advance. As an emergency solution, you can also ask colleagues from the company for help. It is important that the colleagues put on the customer’s glasses.

If you use the pre-test method, the following findings are important for you:

- Content test: Are the questions correct, logical and understandable? How do the participants perceive the scope, structure and language of the questionnaire?

- Technical function test: Do all answer mechanisms work, are mandatory questions also in the system as such, are branching correct, etc.?

You will see: With every pre-test, new insights will come out, even if you have put so much effort into it beforehand. Once you've fixed the problems you've found, you're ready to start the actual survey!

Questionnaire templates for customer surveys

If you follow the methods described in this article, you will quickly realize that every customer survey must be tailored to the needs of the company, to your products and to your customers.

Only then will your survey deliver the results that are important for your company. But to give you some inspiration, the easyfeedback team has created some templates for you to use as a basis for your customer survey:

- Template: Customer feedback on the experience with the company website

- Template: Survey on customer satisfaction with your product / service

- Template: Survey on customer satisfaction with customer support

- Template: Customer survey on cancellation

You can also use these templates directly for further processing. Simply select the option “Create new survey” in the easyfeedback tool, here you will find all templates for further use.

If you want to find out what your customers’ needs are with your survey, take a look at the blog post 12 questions for your customer survey to detect customer needs.

You can simply copy the questions from the post or download a sample questionnaire in Word format.

Conclusion: Methodically good and professional customer surveys mean work

As you can see, designing customer surveys isn’t witchcraft, but it is a bit of work if you want to do it professionally. The following points are the most important ones:

- Define clear goals

- Start small

- Conduct several shorter customer surveys rather than one large one

- Plan the structure from the respondents’ point of view

- Start with questions that are easy to answer

- Make a good mix of easy questions (mostly closed questions) and more difficult ones (tend to be open-ended questions)

- Give participants clear, simple, and brief instructions

- Do a pre-test and tweak the questionnaire before the survey starts.

If you follow the method recommended in this post, customers will feel comfortable answering the survey, you will have few dropouts. And above all, you will be able to use good and usable answers for a meaningful evaluation.

If you would like more details on one or the other point, then take a look at our manual on designing customer surveys. Here I cover individual topics in depth and give you a comprehensive method for creating your customer survey.

Image credits cover image: Graphic survey elements: Designed by slidesgo / Freepik ; Photo young woman: Designed by drobotdean / Freepik