>> Video: Attract unmotivated participants to your survey <<

How do we motivate potential participants to take part?

Before we can say how we motivate participants, we first need to look at what motivates participants and why people participate in a survey.

Only when we understand the participants can we tailor the survey to them. Let’s start with the: “Why do people participate in a survey”?

1. Attachment to the author

Bonding with the author is one of the most important reasons for participating in the survey. If I am asked for feedback by a news portal where I regularly consume news, I have a high attachment and, accordingly, a high motivation to give feedback and improve the offer – maybe even in my favor.

2. Knowledge transfer

The opposite of self-benefit is knowledge transfer. Here, the participants are concerned with making their own knowledge available and hoping to make a valuable contribution.

3. Raffles, discounts or goodies (incentives)

Sweepstakes, discounts or goodies are well-known and common means to increase the participation rate. With this, we “buy” participation, so to speak. Which is not necessarily a bad thing.

4. Spontaneous feedbacker

“Today I’ll give some feedback!” – also called spontaneous feedbacker. We all know it from ourselves. Actually, we always have something to do or enjoy our free time and then we come across a survey that motivates us to just join in: Today I’m giving feedback.

5. All others fall into the category: “I don’t feel like it.”

Irrespective of employee surveys, where loyalty to the author is very high, this category can already account for a considerable proportion. But that’s not a bad thing, and it should be. The important thing is that not everyone says that.

I won’t go into categories 1-3 now, because they have their own interest in taking part in the survey.

Category 4 and 5 are much more interesting, but also hang on a much thinner thread. By that I mean that they participate or could participate due to spontaneity, but jump right off at a little thing that doesn’t appeal to them.

And it’s those individuals that are the issue. Each of the groups of people is important to the survey so that we can make a significant statement about the results.

We must always be aware of one thing: The attention span is very short and is only 2-3 seconds.

If the potential participant is not hooked in that time, then they will not participate. You must have noticed that you always have more visitors than participants in your survey. But never an identical number.

What does this tell us? The number of visitors is the number of people who would participate. We first convinced these people to participate during the acquisition phase. The number of participants is the people we convinced from the welcome page or 1st question page to participate in the survey. All visitors who do not participate are lost to us.

Phase 1: Attention – Acquisition

The acquisition phase is the first point of contact with the survey and takes place via a wide variety of channels. Here we make people aware of the survey and ask them to participate.

The invitation is usually made via the following channels:

• via e-mail invitation

• via website > button or other element

• via social media

• via newsletter

• or via other ways

As mentioned above: category 1-3 have an interest to participate. Category 4-5 are more reluctant.

Tip 1: Present the call-to-action (CTA) in the right way

Place and present the button or link to the survey in such a way that everyone can see it at first glance. Not too small and not too inconspicuous. Larger elements are perceived more important than small ones. And if you want the person to click on the button or link, show that it is important.

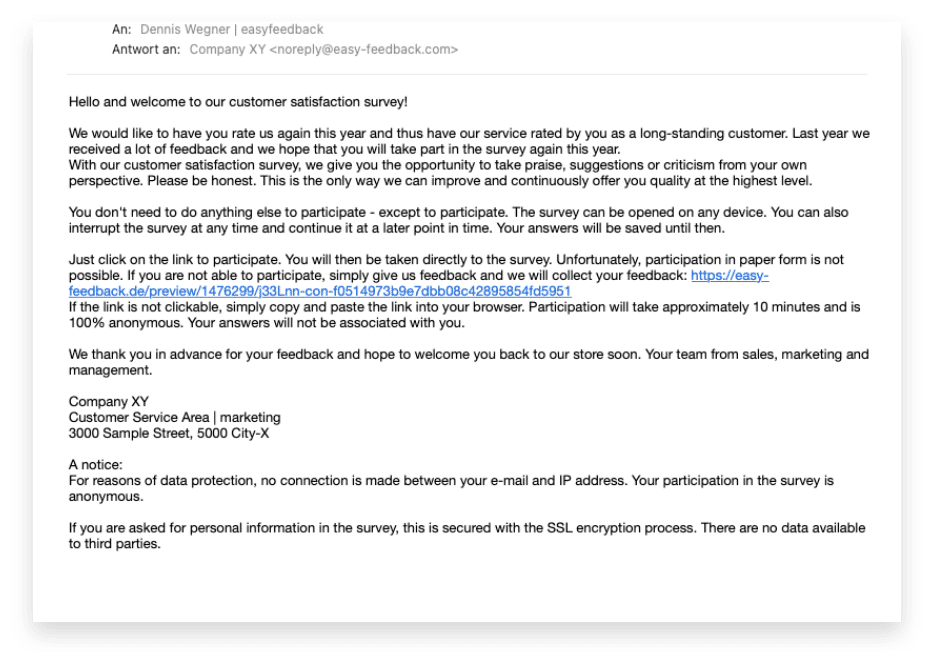

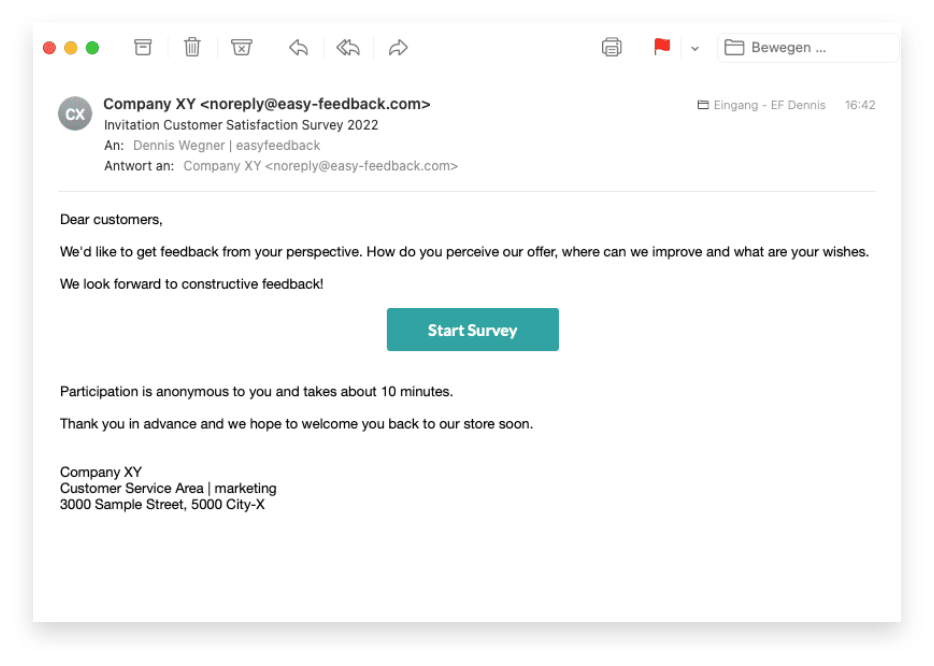

Tip 2: Keep it short

If you invite people to the survey, don’t present them with a huge invitation text beforehand. Even if you want to say a lot in advance, no one wants to read a long text.

Check your text several times and see where you can shorten it. Get to the point and don’t play with the attention span.

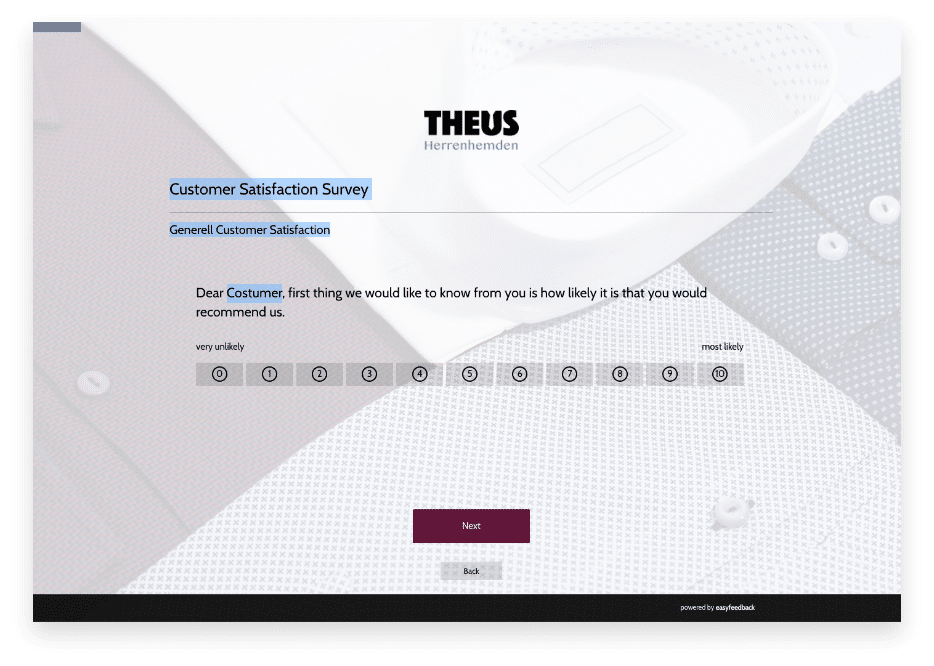

In tip 1 I showed you a long invitation. With this short version, you get to the point and focus even more on the participation.

Short invitation to the survey – to the point.

Tip 3: Ask questions

A good trick to get people’s feedback is to ask questions. Right. A question already in the invitation text could be:

“What is your opinion of the current situation? Would you rate it positively or negatively?”

This alone “lures” the person out of their passive phase and into an active one.

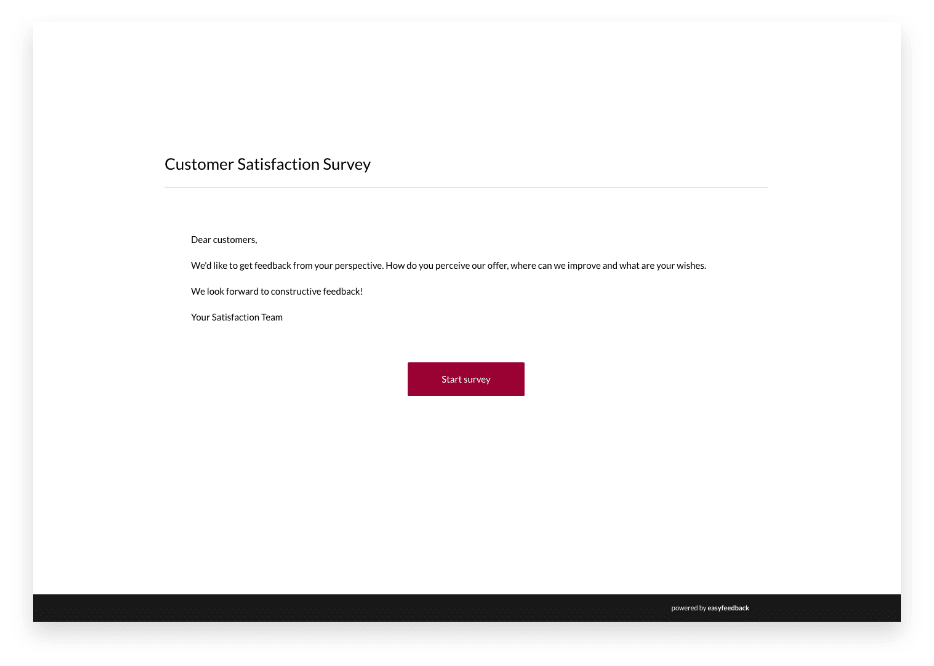

Phase 2: First Impression – Greeting

Once the person has clicked on the survey link, we have caught the person’s attention. This is a good sign because the person is curious or has decided to provide feedback.

By clicking on the link, the person is directed to the survey and “sees” it. And this is where the difference between visitors and participants arises.

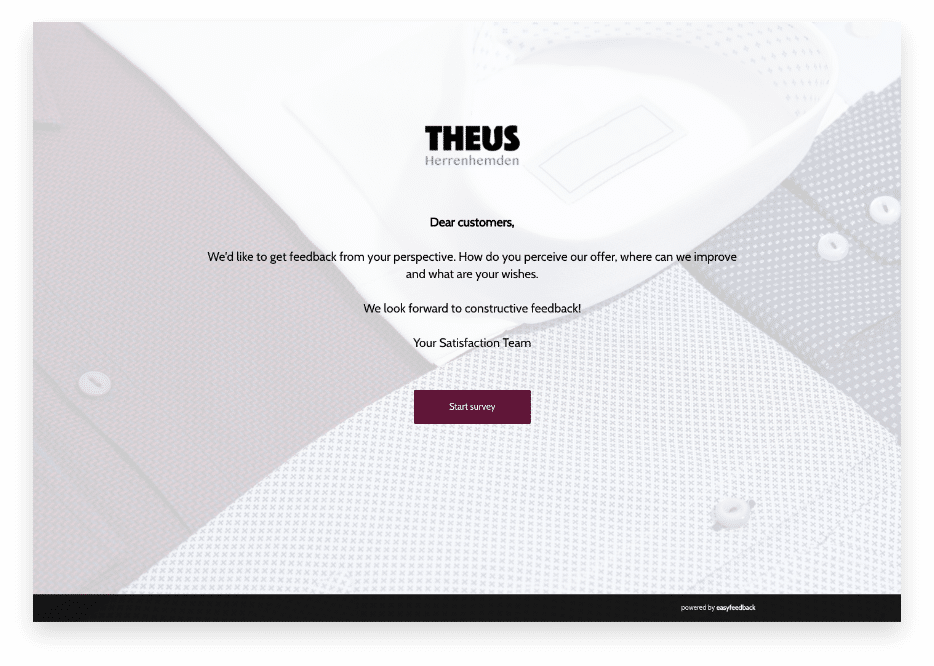

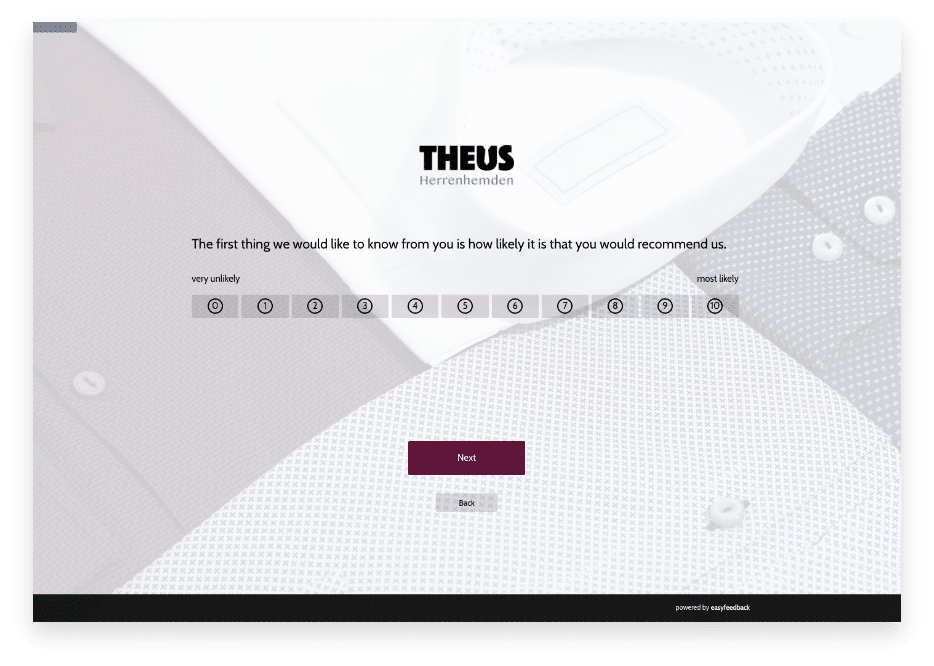

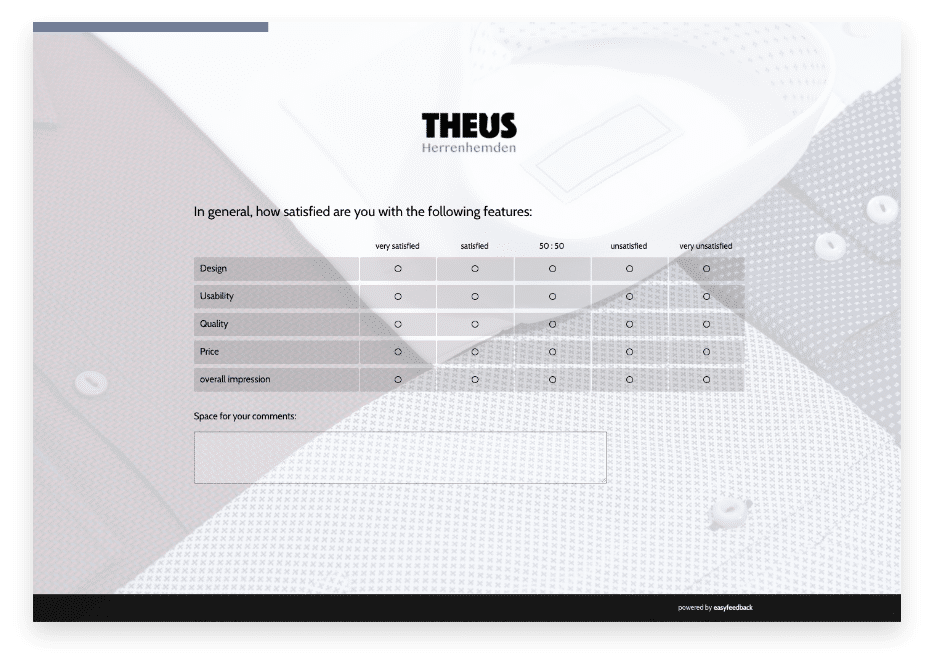

Below I will show you examples of how a welcome page can look like. Decide for yourself which variant motivates you to participate and which does not.

Additional tip: Avoid duplication If you've shown the participant once what the survey is about, then you don't need to do it multiple times. Or even put the same text on the welcome page as in the email invitation. We don't have to. It de-clutters the textual part and doesn't pull on the participant's attention span.

Phase 3: Information content – survey

Here, too, I always see potential for improvement. Over the years, we have continuously developed easyfeedback and offered new functions and options so that each survey can be created according to your individual requirements (information content).

However, I also see that often all possibilities are used and therefore there is an oversupply of information.

We offer many possibilities, but they do not all have to be used 😉

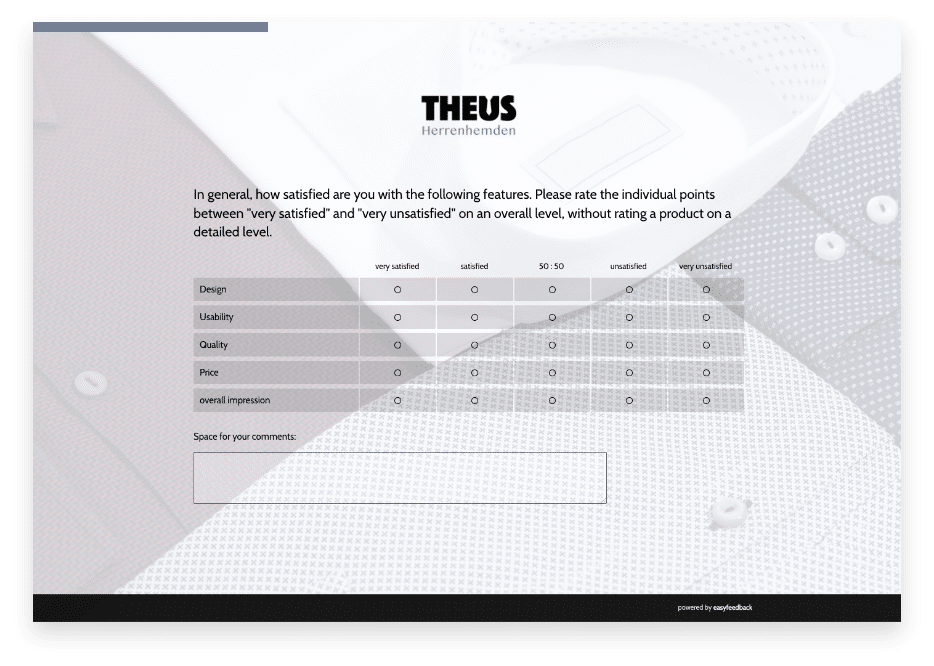

Tip 1: No duplication of content

Sounds totally simple, but often seen in practice. The survey title says “Customer survey 2022”, the page title says “Customer feedback – product group A” and the question title says: “How satisfied are you as a customer?

Thus, the content of the survey is communicated at three positions – very close together. In the question title, it would be sufficient and thus reduce the information content to the essentials.

Tip 2: Simple and short texts

As a final tip, always take another look at your texts in the survey. Are the question texts written “simply”? Can I shorten the texts or get straight to the point.

If your question titles contain convoluted sentences and are preferably over 4-6 lines long, this will scare off participants and come across as “heavy fare”.

Tip 3: The leaner the survey, the higher the motivation

We don’t need to look at studies to assess this. We can evaluate this from our own perspective.

If I am presented with little text, then it looks simple & concise to me and suggests a “short & simple” survey that I can complete “quickly”.

Review your survey with these tips. You’ve probably already implemented some things or you can still find 1-2 points to optimize.

When optimizing, always put yourself in the position of the participants: How do they perceive the invitation, the introduction and the survey? Would you answer the survey yourself or would that be too much for you in the respective situation?

This way you will always have a good feeling if everything fits or if adjustments have to be made.

And finally, I have a few tips for you from my video series on the perfect survey.

>> Video: 8 tips for building your questionnaire <<

More tips & tricks for surveys

- Evaluating surveys with easyfeedback: Effectively collect and analyze feedback

- How long should a survey be open for responses?

- 8 tips for building your questionnaire

- Tips for increasing participation rates in employee and customer surveys

- 10 tips to increase the response rate of your survey

- Why you shouldn’t ask as many questions as you like in your survey

- 7 proven practical tips for creating your next questionnaire

- Formulating texts and questions when creating your questionnaire

- Survey or questionnaire? Find out the decisive difference!

- Planning a survey – systematically gaining insights