>> Video: 8 tips for building your questionnaire <<

Tip 1: How to define the target group and survey goal

Before you start developing the first question, sit down and define the goal of the questionnaire. What do you want to achieve with the survey? If you do not define a goal at the beginning, you will not reach your goal. Sounds trite, but it is true.

Basically you have two target groups to which you can orientate the questionnaire development:

- Employees: Surveys in the company. These can be organizational surveys (e.g. for participation in an event) or evaluations of employee satisfaction, internal communication or 360-degree feedback for managers.

- Customers: There is a wide range of definitions in the area of customers: Are they end customers, business customers or future customers? In addition, market research is a separate, large sub-area of customer surveys.

But now it is not enough to decide on a target group and get started. For example, if you select “customers” as your target group, you need a more precise specification for a well-founded survey. Draw a picture of the people you want to survey!

An example:

Your initial situation:

Your company sells affordable, modern furniture online. You know that an important target group is rather young people between 18 and 35 years: Students who are moving into their student flats or young families who are furnishing their first own apartment. In this target group you have noticed that there are many shopping cart cancellations and that it often remains a one-time order. You want to find out why.

Your target group definition for the survey:

Customers (B2C), first-time buyers. For the time being, you do not limit the age, because this is not a mandatory entry when ordering. If necessary, you can answer this question in the questionnaire and try to find out later on during the data analysis if there are different behaviors in the different age groups.

Your objective for the survey could be as follows:

With the online survey, all new customers in the B2C sector should be asked about their experiences in the ordering process in order to identify possible weaknesses and to achieve more sales through an optimized ordering process.

With this example, you can already see how the survey will become concrete. On the one hand, you will take into account during the technical questionnaire development that you only display the survey to new customers.

If this is not possible with your software, you can use a simple filter question to find out right at the start whether the customer is a first-time buyer. You might send existing customers for a simple NPS evaluation and only new customers show your questionnaires.

Tip 2: How to formulate good questions

With a few simple rules and tips, you can formulate questions for your questionnaire that your survey participants will quickly grasp. Comprehensible questions make it easier to answer the questionnaire and thus increase the completion rate.

Use this short checklist when formulating your survey:

- Don’t include word monsters: “We would like to conduct a customer satisfaction analysis with you.” The eye can’t grasp these giant letter formations and the reading flow falters. You’re better off writing “Customer satisfaction is important to us.” The reading flow is much easier and the wording is more charming.

- Avoid foreign words: Even if you think you’re using common words: Your survey respondent may not be familiar with them. And they won’t Google for them. Avoid using them if possible.

- No negations or suggestive questions: “Don’t you think the ordering process could be optimized?” If you also formulate what you yourself see as in need of optimization in negative terms, your participant will also see it as negative. Especially since you have already put the answer directly into his mouth with the question. Remain neutral when asking the question: “Which areas of the ordering process could be optimized?”

- In a nutshell: Avoid long and nested sentences in the question. Do not try to put all the information in one question. In the worst case, the question may extend over several lines. Formulate briefly and concisely, if necessary use a second sentence. If you have to explain your question in several sentences, check them again thoroughly.

- Communicate at eye level: Do not formulate from above. Communicate at eye level with the participants in the questionnaire. No one wants to be patronized.

- Avoid internal names or empty phrases: Remember that you are not sitting next to the participant while he or she is filling out the questionnaire. As with foreign words, internal terms or phrases should not be used in a customer survey. In employee surveys, internal terms may be used as long as the colleagues know them.

Always ask yourself if your participants can understand the question. The correct use of text and phrasing will help you to ensure that many participants complete your survey and do so as completely as possible.

Stay authentic when formulating

Pay attention to the style of writing. If you practice a relaxed working atmosphere, it is a good idea to write the survey in the same style.

Stay authentic at this point and continue your communication style: You have a “you” culture in your company from the cleaners to the CEO? Then it would seem strange to your employees if you suddenly called them by their first name in the survey, wouldn’t it?

In a customer survey, things can look quite different. Perhaps you use the polite “you” in web and print? Then stick to it in the survey, too.

Otherwise, your survey participant will recognize who the questionnaire is from, but textually he will not associate your company with it.

Or can you imagine a hip start-up designing its questionnaire in the writing style of a bank?

Tip 3: How to put your questions in a meaningful order

It is in our nature to want to achieve a perfect result right from the start – this is also true when creating the questionnaire. However, this will hinder you in the conception of the questionnaire or bring you to a standstill again and again. You have two possibilities to get ahead in the questionnaire development:

- The first way: Just start writing, then sort

- The second way: You ask questions about a concrete process or procedure, then you also orientate your questioning on this procedure.

Step 1: Write, write, write

At the beginning I recommend that you simply write down all the questions that come to your mind. Then you will have an overview of the individual topics that are important to you.

Step 2: Create topic blocks

Sort your questions thematically into blocks. Put these thematic blocks in a meaningful order:

- Simple questions first:

Work with simple questions, at the beginning of your questionnaire. Use simple (click) questions that ask about the target group affiliation.

For an employee survey, for example, the department, location, length of service, position, etc.

In a customer survey, you would ask for some personal information here. This will provide you with valuable data to filter the results according to these criteria later.

An exception is market research. In this area it has proven to be optimal to ask for demographic data at the end.

- Check for duplicates:

Once you have sorted the questions, you start checking for duplication. Delete these questions or merge them with existing ones.

Now you have a good structure in your questionnaire. When you go through it, you will feel if there are any additional questions that are missing in order to achieve your survey goal.

Tip 4: How to specify questions

Let’s take the example of optimizing the ordering process in the furniture online store. Here we have a precisely defined survey topic. Now we still needed the appropriate questions. Actually, it is quite simple now, isn’t it?

You want to find out how the ordering process was, so you ask:

The good thing about this method:

- You get straight to the point and the question fits exactly to your objective.

- You have a very short survey.

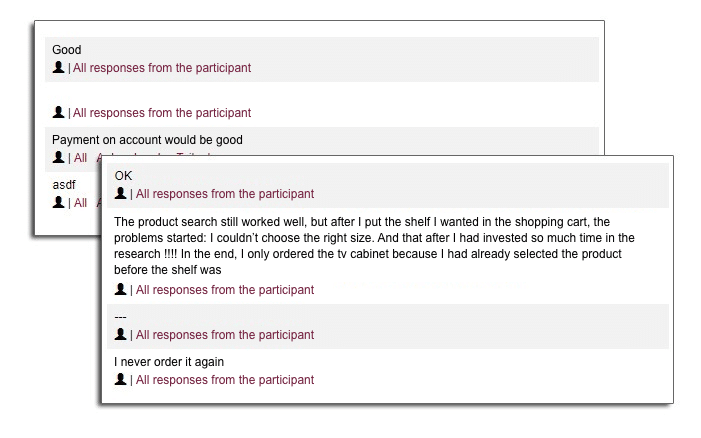

You place your survey online and wait. Then you receive your results after a few days, and there you go:

You are now facing some problems that have arisen through this simple method:

- The processing will be very time-consuming for you! Because the answers are manifold and unstructured! From a simple “Good!” to a simple “OK”. From further payment requests to a complaint in the form of a short novel.

- Many customers are lazy about writing: Your customers may have experienced problems but don’t take the time to formulate them. Or they are already annoyed anyway because the order was bumpy. It is often too much to ask them to report about it now.

- You are missing details: Try to optimize your order process using your received answers. It’s going to be a bit difficult, isn’t it? To get meaningful results, you need more detailed feedback. Even if a customer has taken the time to answer – what action do you take if you don’t know what exactly “lousy” was?

And therein lies the key to planning your interview.

Your solution: 1. Start from the back: Think about what results you need to derive measures from the feedback you receive from your survey. Only these questions are allowed in the questionnaire. 2. Choose questions and answers that accompany the ordering process: In order to optimize the ordering process from the first contact to the completion of the order, you have to ask questions about the individual steps in the course of the order and put them to the test.

In our example we try to concretize the question “How did you feel about the ordering process” and accompany the customer from the search to the purchase through all steps and make it easier for him to fill out the survey with answer options:

- Step 1 | Calling the website

How did you hear about (product XY)?

( ) I have searched online for this product

( ) The product was shown to me when I visited www.website.de

( ) I have searched on www.website.de specifically for it

- Step 2 | Call up the product detail page

Did the product description provide you with all the information you needed to make a purchase decision?

( ) Yes

( ) No. I would have liked the following additional information:

- Step 3 | Product selection

Were you able to quickly find and select the right product variant in the online store?

( ) Yes

( ) No, because ____________________

- Step 4 | Checkout Process: Customer Account

For the order you had to create a customer account.

Would you have liked to place an order as a guest?

( ) Yes

( ) No

- Step 5 | Checkout Process: Payment

Which payment method did you choose?

Would you like to use other payment methods? If yes, which

Are you satisfied with the delivery time of 2-3 working days?

As you can see, you receive more and more detailed feedback with targeted questions, on the basis of which you can make decisions for optimization.

Of course, you have to consider the right answer options for your situation. You may also want to split up questions and work with branching questions to make the questionnaire clearer.

The use of open questions

In the example above, we have turned an open question into several closed questions. This works because we know the process and because we can also use the answer option “Other”. Nevertheless, you should always think about using open questions in your survey.

When creating the questionnaire, we are inclined to do the planning from our perspective. Of course, because you have the greatest relation to your company or product and want to get feedback on certain areas. But do your customers and employees have the same perspective? Not necessarily.

With closed questions you provide the answers. Maybe your customer is missing “his” answer option. Or he feels restricted by the small “Other” field. Or you are already influencing him by giving him the answer options.

For product-specific topics, or when it comes to individual opinions, you will only get limited results with pure click questions. Every person has a different perspective and different needs. It is difficult to find answers to these questions with ready-made answers.

With an open-ended question you give the customer or employee the opportunity to give individual feedback and get answers you probably wouldn’t have thought of.

Tip 5: How to use follow-up questions correctly

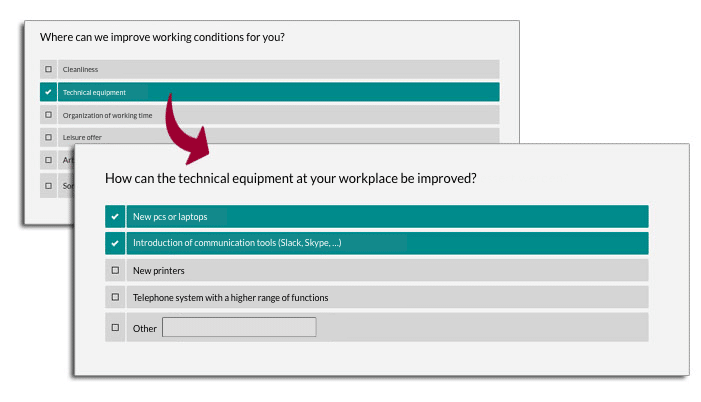

Let’s assume that you have made the decision to conduct an internal employee survey to determine the satisfaction of individual employees. With the questionnaire you would like to find out where improvements can be made in the workplace or in internal processes.

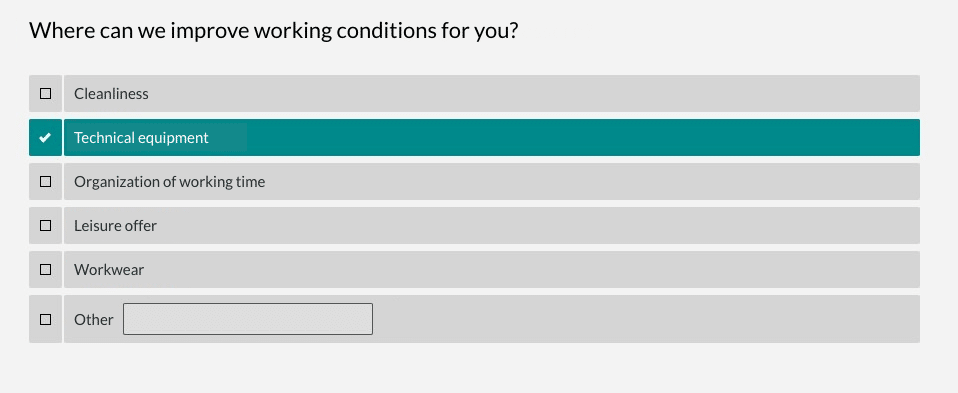

The question would then look like this:

By asking questions, you directly address the needs of the employees and offer improvements that contribute to their satisfaction. But can you also derive concrete measures from the result? No.

Although you will receive a percentage distribution of how many employees would like to have better technical equipment, you will not get any concrete details about what can/should be improved.

You can choose two ways to specify your question in order to be able to take measures after the survey:

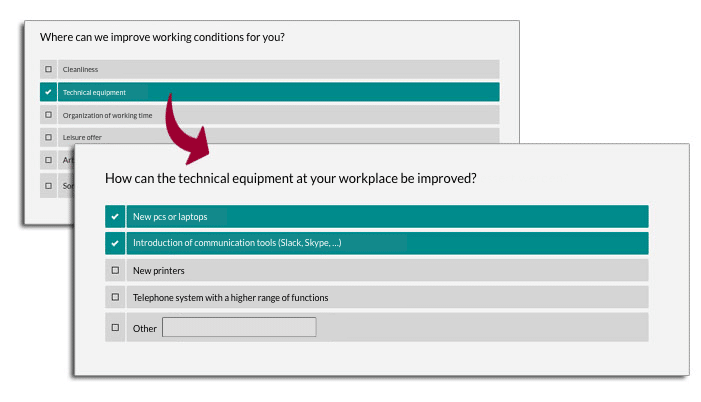

Option 1: Add follow-up question

You ask a supplementary question for each of the above answer options, which is only displayed if the participant has selected the corresponding answer option:

Option 2: Split question

If you know that all the answer options will be relevant for the majority of employees, then split the question. Each answer option becomes a separate question, where you specifically address improvement opportunities:

You can also choose a combination of these variants and your follow-up question can provide concrete answer options. This way you can better evaluate the survey results than with an open question.

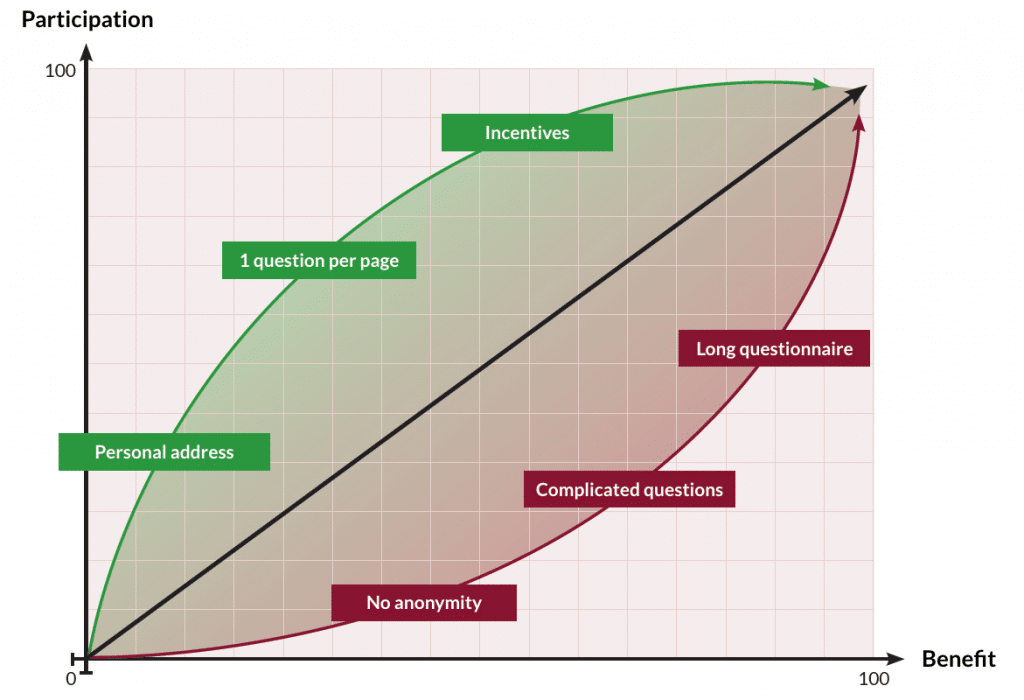

Tip 6: How to find the right questionnaire length

When planning your survey, you will soon find that your questionnaire will be very long because you can think of a hundred things you want to have feedback on. In theory, this is also great, but keep in mind that the patience of the participants is not infinite. The perfect questionnaire length depends on several factors.

The most important factor is the participant’s “loyalty ” to your company. The higher the bond, the more you can expect the participant to do:

- In an employee survey, where loyalty to the company is high, the questionnaire can be longer and more complex.

- However, if you conduct a survey of potential customers via social media channels, you cannot expect the participants to take part in a 30-minute survey. You would not do that yourself.

A simple example:

You bought a new car. Shortly afterwards you are invited by the manufacturer to a survey. Here the bond to the brand is very high, since you have “actively” decided on this brand and model.

If a manufacturer, with whom you have no ties, were to approach you with a market research survey, you would then …

No, probably not.

“Sounds great, then we can ask a long and complex questionnaire in our employee survey, everyone takes part and we get really good feedback every month.”

Unfortunately, no.

You will still get good feedback in the first month and in the following months it will become less and less.

Why is that so?

We humans learn very quickly. If we are invited to an employee survey today and go through it, we know the extent of it. Now when we receive another invitation to the survey in a month’s time, we have the last survey in mind and the “effort” behind it. So the participation rate will decrease from time to time.

It is better to keep the willingness to participate at a high level. An important point here is the length of the questionnaire. If it has been internalized that participation is easy and quick, colleagues will gladly take part in the following surveys.

But sometimes there is no way around making your questionnaire a bit longer so that you can get useful results. Here I have 3 more methods for you, how you can help yourself in this situation. This way you can sometimes create a slightly longer questionnaire and still keep the drop-out rate low.

Method 1: Provide variety

When you make your online survey lively, you increase the attention and length of stay of the visitor. Therefore use different question types. You keep attention high by alternating between different question types when developing the survey. Always using the same question types will quickly tire the participant.

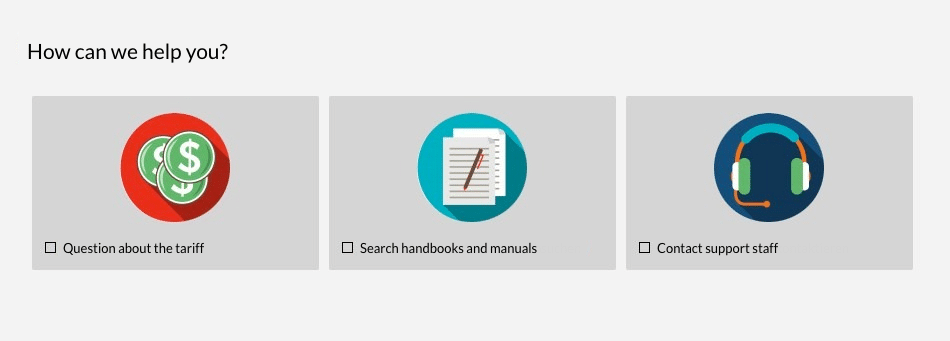

Method 2: Work with images

Images are another way to place varied content in the survey. If you use a questionnaire as a contact form to offer support, the first question is

“How can we help you?”

You can either type the answers as text, or you can use picture questions to visualize the possibilities. This makes your questionnaire look livelier and surprises the participant.

Method 3: Saving questions without sacrificing results

With a simple trick you can shorten your questionnaire or add another additional question without changing the length: Give yourself previously known information in the survey link.

For example, you might want to see at the end of the survey which of your customers gave which feedback. Since you have the customer number, you can hand it over with the survey link and don’t have to ask for it anymore.

With different mechanisms like URL parameters & variables, or multi-links, good survey software offers the possibility to put information in the survey link that shortens the questionnaire.

Tip 7: How to define mandatory questions

With your questionnaire you want to get as much feedback as possible and you want every participant to answer every question. The option of the mandatory question comes in handy. Although it is tempting to set each question as a mandatory question, you should use this option with care.

- Questionnaire process on the basis of given answers

If you customize the course of the questionnaire with filters, jumps or logic, you have to activate the mandatory question option for the filter questions. Otherwise no individual process can take place.

- Which question is used to evaluate the results?

It is recommended to set certain questions as mandatory questions, with which you want to evaluate the results later. For example, for an employee survey: In this case, the question about the department you belong to should be a mandatory question so that you can later evaluate the result properly based on these answers.

- Which question has the greatest benefit?

Depending on the subject of the questionnaire, there may be one or more questions that constitute the absolute core of the survey. These questions should also be answered. Here it is in your interest to set them as mandatory questions.

- Put yourself in the participant’s perspective when selecting mandatory questions

Every mandatory question must be answered. If the participant cannot or does not want to answer, he or she will or must cancel the survey at that point and you will lose feedback.

- From a psychological point of view it can make sense to set many mandatory questions

This is done so that each question is “actively” perceived. In this case, however, you should in many cases offer an option for the participant to continue the questionnaire without “answering”.

To do this, you can use the “No answer” button. This allows to answer the question technically, but without the participant having to give an answer.

Conclusion: Use the right methods for questionnaire development

With the right methods in mind, planning a good survey is not that difficult. Admittedly, such a survey is a bit time-consuming, but by using a good software, you can save a lot of time when evaluating the survey.

Because you should not rush anything when planning a survey. Thoroughness and accuracy are required here. And self-discipline is also needed to limit yourself and refrain from asking the one or other question.

This is the only way to ensure that your questionnaire has an appropriate response rate and that you can derive important insights and improvements.

More tips & tricks for surveys

- Evaluating surveys with easyfeedback: Effectively collect and analyze feedback

- How long should a survey be open for responses?

- 8 tips for building your questionnaire

- Tips for increasing participation rates in employee and customer surveys

- 10 tips to increase the response rate of your survey

- Tips & tricks to motivate more participants to take part in the survey

- Why you shouldn’t ask as many questions as you like in your survey

- Negative feedback after a survey: how to best deal with it!

- Formulating texts and questions when creating your questionnaire

- Survey or questionnaire? Find out the decisive difference!

- Planning a survey – systematically gaining insights