Quantitative vs. qualitative growth

Before turning to individual key figures, it is important to distinguish between two forms of growth:

- Quantitative growth describes measurable variables such as revenue, profit, sales, or number of employees. It stands for an “increase” in economic performance.

- Qualitative growth, on the other hand, refers to improvements in organization, product quality, customer satisfaction, or innovative strength. It means “better,” not necessarily “more.”

Sustainable corporate growth is usually based on a combination of both aspects.

Important methods for measuring growth

1st method: Period comparison

This involves comparing key figures over several periods (months, quarters, or years).

This allows trends and developments to be identified.

2nd method: Benchmarking

Benchmarking involves comparing your own growth with that of competitors or industry standards.

This helps you to better understand your own position in the market.

3rd method: Break-even analysis

This method shows the point at which a company starts to grow profitably and can serve as an early indicator of healthy growth.

4rd method: Balanced scorecard

A strategic management tool that takes both financial and non-financial indicators into account (e.g., customer perspective, internal processes, employee development).

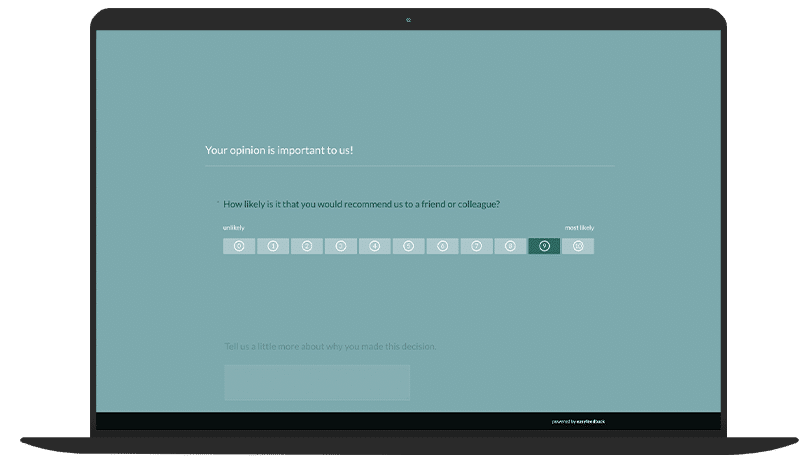

5th method: Surveys

Employee, customer, and partner surveys are a valuable tool for capturing soft factors of growth.

Examples:

- Employee satisfaction:

Provides insights into internal culture, retention, and long-term performance. - Customer satisfaction (e.g., NPS – Net Promoter Score):

Measures how loyal customers are and how likely they are to recommend the company to others. - Innovation climate & corporate culture:

Internal surveys on willingness to change or leadership style provide qualitative insights into sustainable growth.

Surveys thus supplement the key performance indicators with perspectives that are often not visible in purely numerical data.

Key figures for company growth

1st key figure: Sales growth

Sales growth measures the percentage change in sales between two periods (e.g., quarters or fiscal years). It is one of the key figures used to assess a company’s economic success.

Formula:

(Sales in period 2 – Sales in period 1) / Sales in period 1 × 100

2nd key figure: Profit growth

Shows whether the company has not only generated more revenue but also operated more efficiently.

3rd key figure: Employee growth

An increase in the number of employees may indicate expansion, but must be considered in relation to productivity.

4th key figure: Market share

Shows how the company has developed relative to the industry.

A growing market share signals increasing competitiveness.

5th key figure: Customer growth / new customer acquisition

A measure of how successfully the company is tapping into new markets or target groups.

6th key figure: Net Promoter Score (NPS)

A standardized value from customer surveys on willingness to recommend – as a reflection of customer satisfaction and loyalty.

7th key figure: EBIT or EBITDA growth

These key figures allow for a differentiated view of operating profit – independent of taxes, interest, and depreciation.

8th key figure: Growth in equity ratio

Indicator of a healthy capital structure and long-term financial stability.

Conclusion

Growth is a complex phenomenon—and measuring it requires a holistic view.

While quantitative indicators such as sales or profits provide short-term insight into performance, qualitative methods such as employee or customer surveys often reveal sustainable success.

They shed light on the “why” behind the numbers.

Companies that combine traditional metrics with opinion polls and feedback obtain a realistic picture of their development – and are thus better able to make smart decisions for the future.