Getting information on customer satisfaction is not that easy. Because your customers themselves don’t know exactly how they imagine their optimal customer experience.

Why? Because they’re human. And we humans know pretty well what we don’t like. But we can only imagine what we like within the framework of what we know.

You can solve that problem easily, though: If you ask the right questions in your customer surveys, you won’t just get answers from your customers and potential customers.

You’ll also find out where their problems lie, how you can help them, how you can tailor your offering and your marketing to their needs – and how you can offer them the optimum customer experience.

>> Video: 3 Customer Experience Touchpoints <<

How do customer experience and the customer lifecycle relate to your customer survey?

In order to set up your questionnaire correctly, you first need to understand the different phases of the customer lifecycle and the characteristics of customer satisfaction.

A customer experience (CX) is something that every buyer has with every product. The question is: Is it a good experience? In general, the CX can be divided into three phases, one speaks of the customer life cycle:

1. Phase: The initiation phase

This is the phase that is almost always dealt with exclusively by Marketing and Sales. This is because the aim of the customer survey is to find out how to reach the customer and how to lead him to a deal.

In this phase, the customer first becomes aware that he has a need. Then he becomes aware of you.

He explores his options, looks at different providers. Compares prices. He listens to acquaintances and experts, perhaps consults test reports. Maybe he downloads white papers or takes part in webinars.

Finally, he makes his decision and buys/commissions. He then enters phase 2.

2. Phase: The active phase

The customer is now a buyer and receives the ordered product. Or he installs it or uses it for the first time. In this phase, he may have contact with support and customer service. If you have key account managers, then he has to deal with them.

They take care of him and maybe get him to buy/order/use more. In the best case, this phase lasts as long as possible. Targeted customer surveys can help you with this. At some point, the customer then practically always enters the 3rd phase.

3. Phase: The passive phase

The customer no longer uses the product or your service and eventually quits.

Your customer service can contact him at this point in the course of a customer survey and try to keep him. But that’s not all, I’ll get into that in a moment.

The bottom line is that CX is a multi-layered process where the customer deals with many people and places at your company. And all of them are crucial to whether the customer is satisfied, whether he recommends you to others, and whether he remains your customer.

To improve customer satisfaction, you should address all phases as part of your customer survey. And do so across departmental boundaries – not just in marketing, sales or customer service.

Optimizing customer satisfaction is a great opportunity to talk to all your colleagues in the company who are even marginally involved with customers. Together, you can take advantage of the following opportunities to get even better.

What to do before your questionnaire is launched online

Before you start with your customer survey, you should take the time to think about the basics of your survey. If possible, don’t do it alone, but with the relevant stakeholders in your company.

Define goals for your customer survey

Before you start with your customer survey: the effort of a survey is only worthwhile if you know what you want to do with the results:

- Do you even have the time and budget to address change?

- In which areas?

Choose the areas you want to investigate accordingly.

Because it’s not much use if you know what could be improved, but there are no resources to actually implement it. This is another reason why it’s so essential to approach CX collaboratively across departments.

Plan well to make it easy for your respondents

We humans are comfortable. And we are in our leisure time as well as at work.

That means you have to overcome comfort if you want people to answer your questions in customer surveys. Because no matter how enthusiastic you yourself are about your company: To your customers, you’re just one of many.

Consider the following points when planning your survey:

• Set goal and effort in a good relationship

And they know that every company likes to know from customers what they want. So when they take part in a survey, they only take a limited amount of time. The effort must be in the right proportion for them.

A vendor whose software you use for several hours every day, for example, you’re sure to give half an hour yourself – if you like the product or you’re asked nicely. A vendor from whom you buy something once a year for a few euros, you certainly don’t have that much time to spare.

So you have to be realistic about how much you can ask your customers. Of course, you have to make it clear to them why it’s a great thing that they answer you and what they get out of it.

But that’s a topic for another post, there are some highly effective methods.

• Keep it simple!

When setting up any survey, the most important thing is to make it as easy as possible for respondents. Then you’ll get a lot of responses and, above all, their quality will be high. That way you can really work with the results.

The more answers you want, the easier you have to make it for the respondents – that’s also customer service. And that’s why it’s proven to work in two stages for many questions:

- Conduct preliminary survey

- Conduct the actual survey

The qualitative preliminary study for the customer survey

The first step to a good online customer survey is a preliminary study. This takes some time, but is worth the effort in the end improves the quality of your survey and reduces the dropout rate.

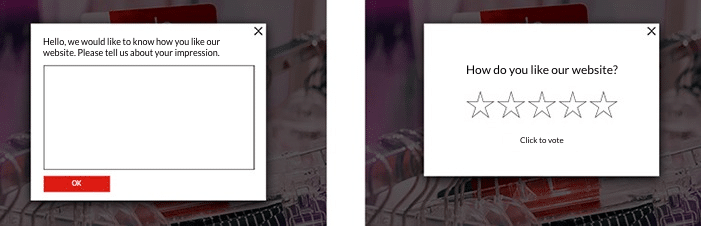

Imagine you come to a website. A layer slides in, saying:

Variant 1: "Hi. We'd like to know how you like our website? Please tell us about your impression." Below that is a box with space for 20 lines of text.

You visit the online presence of a competitor. Here, too, a layer slides in, and it says:

Variant 2: "How do you like our website?" Below that are five outlines of blank asterisks.

Now my question: which online survey are you more likely to take?

The answer is clear – the less work it is for you, the more likely you are to participate.

This is what is meant by making as little work as possible for the respondents. But imagine if the same number of respondents took part in variant 1 with the text field as in the super simple variant 2.

As a company, wouldn’t you rather have all the text responses? That would be a treasure trove of information. In reality, unfortunately, you have to choose: either deep insights or lots of answers.

But there is a trick how you can get both: A lot of information and a lot of answers at the same time. To do this, you combine both types of questions.

The first type is called open questions. Open, because no answer options are given. The second type is closed questions. In these, the respondent can choose from a closed set of answer options.

This is where our preliminary study comes into play

So we start by asking a few open questions. The most important thing for us is to go into depth, to gather as much information as possible, to get as many different views as possible. We are not interested in how common these views, problems or details are.

You can also conduct a qualitative study like this in person. That means you don’t set up an online questionnaire at all, but talk to the interviewees on the phone, at a trade fair or at their office. Often, after 5 to 10 interviews, you have enough information to continue.

After all, the goal here is not to get an overall picture, but only an overview. And you get that relatively quickly. After a few interviews, you realize: The statements repeat themselves.

Derive possible answers for the survey from the preliminary study

At the end of this qualitative preliminary study, you can create a list of problems and wishes of your customers. This is the basis for the questions in your actual online survey. In it, you can then focus on closed questions that customers can answer quickly.

For example, through the customer survey in your preliminary study, you found out that some respondents have the problem that they can’t convince their supervisors to release a budget for your services.

Others said they would struggle to compare the different offerings in the market. And still others, they don’t know how to test the product properly.

Perhaps you would like to add some possible answers that you yourself think are likely, or that you have heard from colleagues in sales. We’ll give you a concrete example of this in a moment.

Questions and online template for the initiation phase

All customers today get information online before buying virtually any product. Therefore, you will meet prospects on your website relatively easily.

Wonderfully, the potential customers can provide you with valuable leads. But customers who have just bought are also a valuable source of information.

Question 1: What are your most important goals with [topic area]?

This is how you find out in your survey what potential customers are interested in. You see which topics you can score points with – in your online marketing as well as in your sales pitch and, of course, in the direction of your offer.

Example: you sell interior design, equipment and merchandise for coffee shops. You might ask:

What are your main goals when buying coffee?

- find the lowest possible prices

- ensure consistent quality

- procure the hottest varieties

- fast delivery

- trustful cooperation with suppliers

- social & ecological aspects

Question 2: What are your biggest challenges when you think about [goal; needs]?

Here you’ll learn how to specifically help clients overcome their challenges and barriers to implementation.

You can then offer advice accordingly or provide a wide variety of online services: Create e-books, make checklists available for download, or offer webinars on these topics.

Or you can enhance your offerings to help customers solve their challenges. Example (we’ll stick with coffee…):

What are your biggest challenges when you think about increasing sales?

- new customer acquisition

- cross-selling/selling more to individual customers

- dovetailing marketing and sales

- increase service quality

- employee management/motivation

Question 3: Where do you see the greatest need for action among providers for [product/service]?

This will help you find out in the customer survey where the weak points are at your company or in the industry or products in general. Let’s take the coffee shop example again:

Where do you see the greatest need for action with coffee suppliers?

- unreliable delivery

- delivery times too long

- too expensive

- no continuity in the brands/origins offered

- too few new brands/origins

- no consistent quality

Question 4: What is particularly important to you in [product/service]?

This question tells you which decision-making criteria customers use. This tells you what you should emphasize in marketing. And in which direction product development should go. Example:

What is particularly important to you when purchasing coffee?

- Quality

- Price

- Delivery time

- Other: (free text field)

Questions and online template for active customer phase

If the customer relationship already exists, then it is easiest to contact people. Almost everyone is happy when you ask them something. But beware: they then also expect their criticism to result in change. Keep this in mind when creating your customer survey.

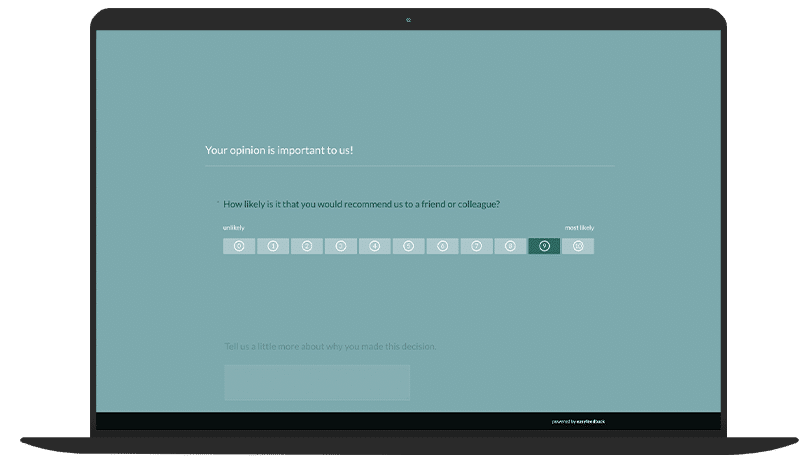

Question 1: How likely are you to recommend us to friends or acquaintances?

This is the classic NPS question (Net Promoter Score, it measures customer loyalty). It tells you how satisfied your customers are with you.

It is very important that you ask a follow-up question: “Please explain your opinion briefly.” This is the only way to find out why customers answered the way they did.

Question 2: How did the [product] meet your expectations?

The answer to this question is interesting. Here you learn about your weak points – but also about the points that make you stand out and that you can therefore emphasize in marketing. If your customers criticize here, it could be for many reasons.

The product could be faulty, but it could also be that people just haven’t understood what your product can do or how to use it.

An application, an online service or a device needs a good onboarding. That is, a good introduction during the first use or startup.

Here I would provide a matrix on a 5 Likert scale. Answers in each case from “Expectation exceeded” to “Expectation not met at all”.

Question 3: How easy was it for you to complete your task?

This question measures the CES (Customer Effort Score). It indicates how tedious your customers found it to work with your product. In our coffee shop example, of course, the question makes no sense for a packet of coffee.

After all, that’s not a task. But the question does make sense, for example, if you want to know how easy a buyer found reordering that packet of coffee.

I would recommend a Likert scale for this question as well.

Question 4: If you could change one thing about our product, what would it be?

This is usually an open-ended question, meaning you provide a free-text field. Of course, this is a bit more work for the respondents and also for you in the evaluation.

But it is still worthwhile to give the customer at least one opportunity to give a detailed statement on a topic that is important to him.

Such a question should be placed at the back of the questionnaire. This gives respondents a quick sense of achievement when answering the closed questions – and if they break off at the free-text questions, you at least have the answers to the first questions.

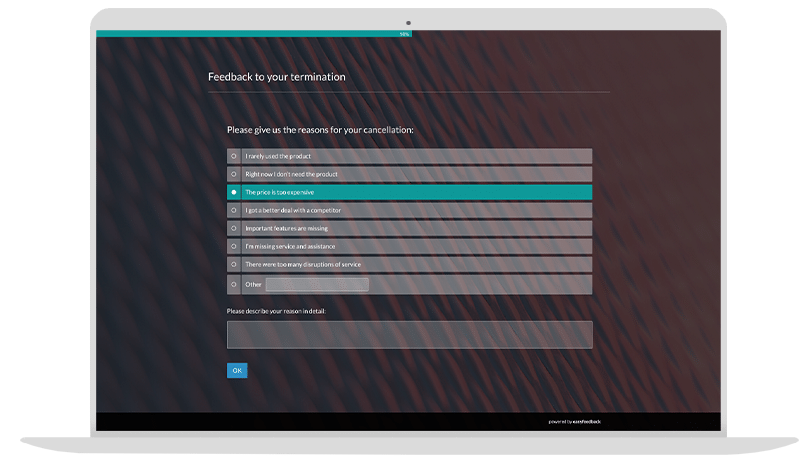

Questions and online template for the passive customer phase

If customers have not used your service for a while or they have not ordered for a while, then they are in the passive phase.

Here, it’s important to contact them as part of a customer survey – perhaps all you need to do to re-activate them is to ask them a question. And you can also learn something from cancellations. Use the survey as an opportunity to retain more customers in the future.

Important: In this case, make it very clear that you really want to learn something. If your lost customer feels that you are trying to persuade them to come back, they will either not respond or get angry.

Question 1: Why did you become a customer with us?

Here you find out what the original motive was, what convinced the customer and made him buy. Here it is more suitable to ask an open question.

However, if you have already been able to find out the most common reasons or motives for purchase in past surveys, asking a closed question will also work:

Why did you become a customer with us?

- Price/performance

- Quality

- Recommendation from colleagues/friends

- References

- Sales representative

- Website

- Other: (free text field)

Question 2: What made you quit?

Now it gets super exciting: What did you do wrong? In which areas did the competition perform better? In our example, it might look like this in your questionnaire:

What made you quit?

- Got a better price elsewhere

- Quality of the goods not as expected

- Delivery not fast enough

- Delivery not reliable

- Took these products out of the program

Question 3: Which product are you using now?

Who is the happy competitor now that your customer has switched to? Here, too, a closed question is suitable, provided you already know the competitors to whom people frequently switch.

Which product do you use now?

- Provider/Product A

- Provider/Product B

- Provider/Product C

- Provider/Product D

- Other: (free text field)

Question 4: What could we have done to satisfy you?

What was missing for the disappointed customer? Where could you do better? A free-text field is recommended here in line with the open-ended question.

After the survey: Say thank you & give feedback

At the end of the survey, remember to say thank you. Respondents made the effort to answer you, they sacrificed some time to make your business better.

That this is valuable is clear to everyone today. Therefore, respondents expect at least a polite farewell at the end of the customer survey.

Perhaps there will also be a small token of appreciation for their efforts. So, for example, a voucher, a discount for the next order or a useful template to download.

If this thank-you comes unexpectedly, it will be perceived even more positively. Everyone loves gifts. And unexpected ones especially.

It’s also important that respondents feel that something is happening with their answers. This is especially crucial for customers in the active phase.

If they have voiced criticism in the survey, they want someone to register it and, in the best case, work on the problem. Surveys require action – asking questions is not enough.

So at the end of the survey, explain what you are trying to do here. You may also be able to offer to have users sign up for a mailing list that will inform them of the survey results and the consequences.

Conclusion: Good answers require good questions

Asking questions is not difficult, but asking good questions is an art. If you follow the tips above, you’ll get answers in your customer surveys that you can really do something with.

That will help you identify and subsequently address customer satisfaction weaknesses to improve your customer service.

And a good survey leaves participants with a good feeling, they feel taken seriously and know they are helping you make your product/website/company better.